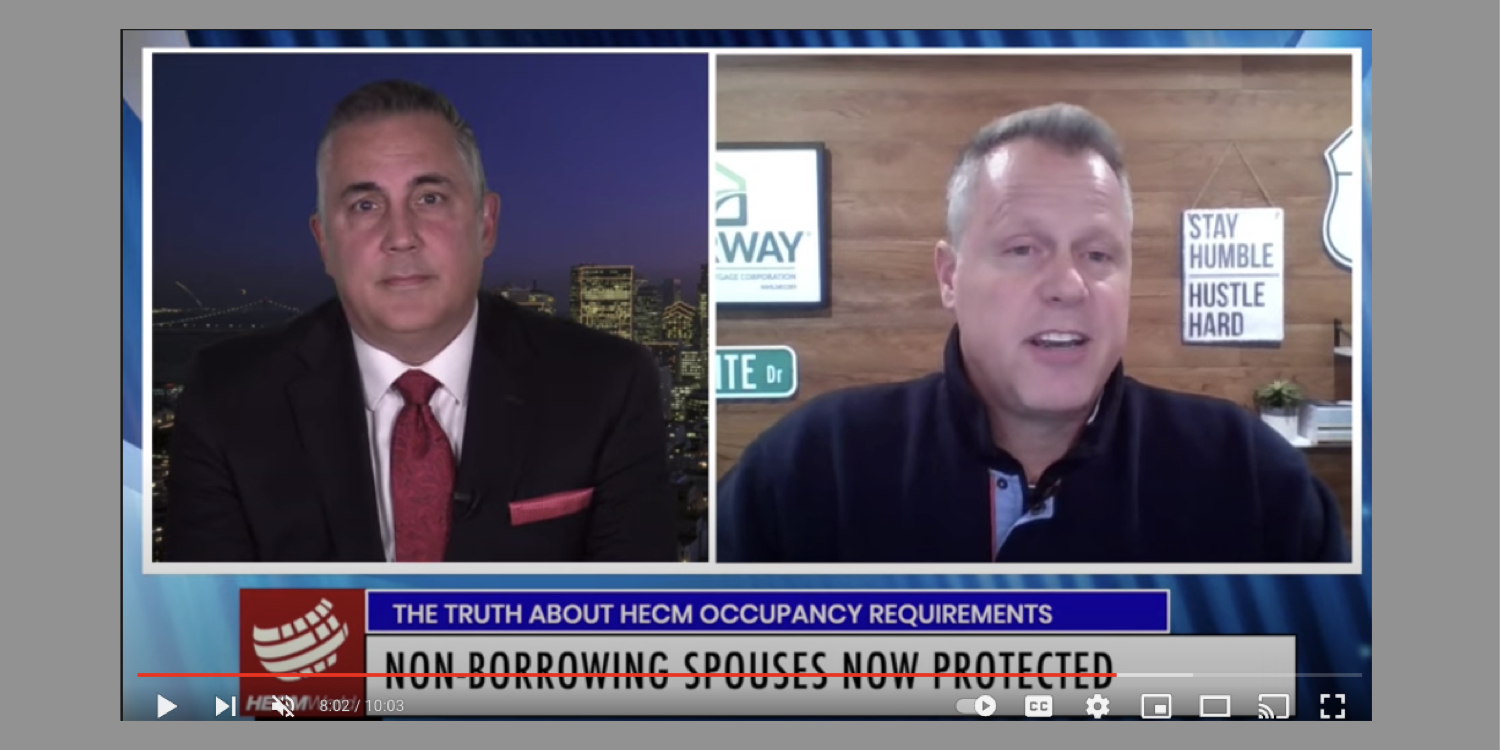

What are the actual occupancy rules for Home Equity Conversion Mortgages? The answer may surprise you as Dan Hultquist explains.

Continue readingRequired Pre-Education?

Require Pre-Education Before Counseling? One groups suggested to the CFPB that a ‘third party’ provide upfront education about the reverse mortgage BEFORE the borrower get’s HUD counseling or meets with a lender. Who would these ‘third parties’ be and who would supervise them?

Continue readingBridge over troubled waters – Retirement Funding

Don’t burn bridges. The HECM is a bridge over the troubled waters of retirement. What must we do to insure it remains a reachable option for future retirees?

Continue readingCFPB Regulations – Play by the same rules: Industry Leader Update

UPDATE: Here’s a link to another article on NMLS licensing & the SAFE Act by Richard Booth.

[ad#Independence Housing Group]

[vimeo id=”33425593″ width=”625″ height=”352″]

Consumer Financial Protection Bureau Regulations

Shouldn’t we all play by the same rules?

The Consumer Financial Protection Bureau (CFPB) says all mortgage originators should play by the same rules…even chartered banks. Why does it matter? What are the two different standards that exist today?

Watch this week’s video and post your opinion.

AARP Regulations – Have they gone too far?

That may be just what future reverse mortgage borrowers may need to do to satisfy federal regulators before getting the loan. AARP recently called for more ‘special protections’ to help prevent serious harm (full story here). What is puzzling is the mixed messages that often come from AARP regarding reverse mortgages; first endorsing and then later criticizing.

When it comes to fraud is our industry rife with it? AARP’s senior attorney cited high fees that ‘scammers’ can use to suck away people’s home equity. Really? Are we on the same page? HUD restructured the loan origination calculation for borrowers lowering fees dramatically from 2% of the homes appraised value some time ago not to mention the introduction of the HECM Saver last October. When it comes to fraud do we have any real evidence that shows a disproportionate problem with reverse mortgages versus traditional loans?

Certainly high fees were a black eye for reverse mortgages but that issue has long been settled by both HUD and the market with mandated loan origination reductions, lower costs to consumers due to the secondary market and new low cost products like the Saver. Are high fees the risk to borrowers exposing them to losing their home or is it a lack of education or responsibility of the borrower to meet the obligations of insurance and property taxes? I would venture to say it is the later, and steps have been taken to reduce that risk to both borrower and lenders alike.

Beyond mandatory counseling, duplicate warnings, disclosures and all caps ‘buyer beware’ statements in an application what additional protections really can be practically put in place? No one would disagree that consumers deserve sound product education and protections but in the end will they need to chew through barbed wire to get a reverse mortgage? What segment of borrowers could potentially be hurt the worst from regulations that treat the HECM as a toxic loan of last resort and what message does this send to our new segment of higher net worth borrowers who may be looking at a HECM for the first time?

Congress to HUD: Fix non-recourse problem

[vimeo id=”22467512″ width=”601″ height=”338″]