When must a reverse mortgage be paid off? Can the loan be paid off early? What are the typical payoff options?

Continue readingSeniors head back to retirement communities

Unable to use the embedded player? Listen here.

EPISODE #729

Seniors head back to retirement communities after the Covid pandemic

As reverse mortgage professionals, we often talk about the vast majority of seniors who want to age in place in their existing homes. This week we bring you the other side of this issue from MarketWatch…

Other Stories:

-

Morningstar: Ilyce Glink: Speaks on the State of the U.S. Residential Real Estate Market

-

CBC: Canadian regulators cap reverse mortgage loan percentage

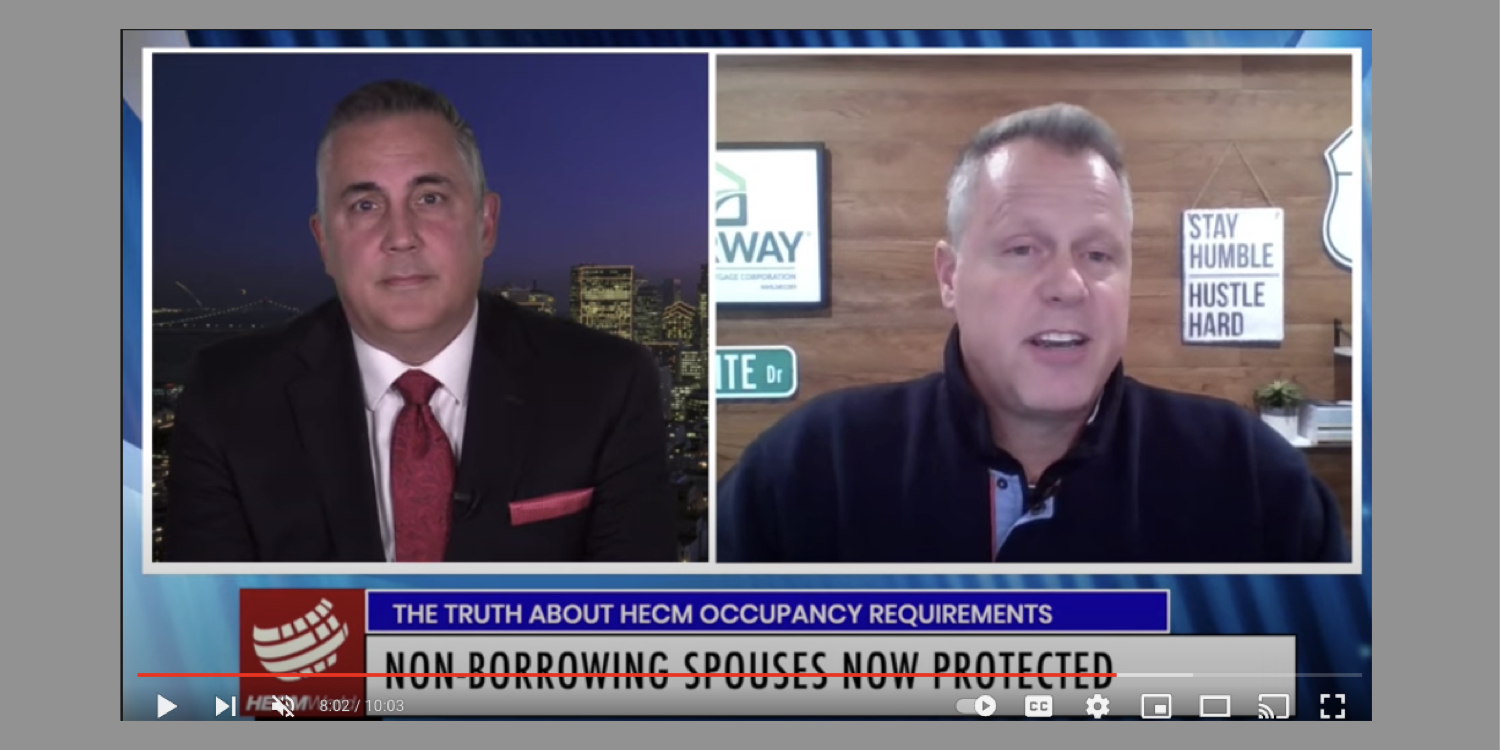

The truth about reverse mortgage occupancy rules

What are the actual occupancy rules for Home Equity Conversion Mortgages? The answer may surprise you as Dan Hultquist explains.

Continue readingNEW HECM Final Rules Begin Sept 19th

HECM Final Rule Changes Begin Tommorw- Part 2: Interview with RMI’s John Lunde

HECM Final Rule Changes Begin Tommorw- Part 2: Interview with RMI’s John Lunde

HUD’s HECM Final Rules go into effect tomorrow (9/19/2017) and include in part:

-

- For fixed rate HECMs, only a full-funded LESA may be used.

- Partially funded LESA’s will distribute LESA funds two times a year to the borrower for the payment of property charges. Fully funded LESAs will directly pay the insurance or taxing authority, not the borrower.

- Initial distribution limits will remain in effect for the first 12 months, but cannot be reduced below a 50% distribution cap without additional rulemaking.

- Sellers are allowed to pay fees required to be paid by the seller under local or state laws, including the purchase of a home warranty policy.

- The seasoning of non-HECM liens looks at the 12 month period prior to the HECM closing.

- HELOCs (home equity lines of credit) are excluded from the 12-month seasoning requirement but are subject to first-year distribution limits.

- All HECM products and features must be disclosed to the borrower in a manner that is acceptable to the FHA Commissioner, regardless of the products offered by the particular HECM lender.

- Borrowers may lock in their Expected Interest Rate (EIR) prior to the date of loan closing or lock in their rate on the day of closing.

- The payoff of unsecured debts not secured by the property as defined by the Commissioner is a mandatory obligation.

GET FULL OFFICIAL TEXT OF FINAL HECM RULES HERE

John Lunde is the president and founder of Reverse Market Insight (RMI). They closely track the reverse mortgage (HECM) industry data points and trends.

What are your thoughts? Please leave your input in the Comments section below, and share this post on social media using the Twitter, Facebook and LinkedIn icons at the top of this page. Thank you!

What just happened? A look behind the scenes.

Even though HUD telegraphed their intentions to make substantial changes to the reverse mortgage program many today are in a state of shock. Here’s brief look behind the scenes courtesy of NRMLA’s special bulletin. First, our industry has been very active in working with those shaping policies for the HECM program. NRMLA and others have been working tirelessly

Continue readingConsumers Union to CFPB: Only as a “Last Resort”

Two consumer groups are urging the CFPB to make drastic changes to the revere mortgage program. Chief among them is a suitability standard and fiduciary duty. In the words of the Consumers Union they recommend that a reverse mortgage be a loan of last resort when there is no other viable option and…

Continue readingLooking ahead: Interview with Urban Financial CEO Steve McClellan

He comes from both a banking and financial services background. Urban Financial CEO Steve McClellan sat with us at NRMLA’s West Coast Meeting and shares his insights on upcoming regulations, market conditions and more.

Continue readingIndustry Outlook: Interview with Peter Bell

What is going on behind the scenes and what can we expect this year? See our interview with NRMLA President Peter Bell to learn more about regulation, lawmaking effecting reverse mortgages and more.

Continue readingSituational Awareness

The trick is to separate what we can control and with the rest merely absorb the information and move on. Fighter pilots have a term for this when flying called “situational awareness”

Continue readingCFPB Audit: What to expect

The Consumer Financial Protection Bureau has begun it’s audits of non-banking lenders. What can we expect to see? How will reverse mortgage lenders respond?

Continue reading