Despite the Federal Reserves rate hikes inflation has begun to surge. A look at the underlying factors that continue to push up the cost of living…

Continue readingSenior debt is climbing while inflation accelerates. Is there a way out?

Sandwiched between the Millennials and Boomers Generation Xers who are poised to become the next reverse mortgage market.

Continue readingTwo things most reverse pros don’t know about the expected rate

Industry expert, author, and founder of Understanding Reverse contributed a column to Housing Wire’s Reverse Mortgage Daily that reveals two often overlooked facts about the HECM’s expected rate used to determine the federally insured reverse mortgage’s principal limit.

Continue readingWhat HECM Pros Should Know About Inflation

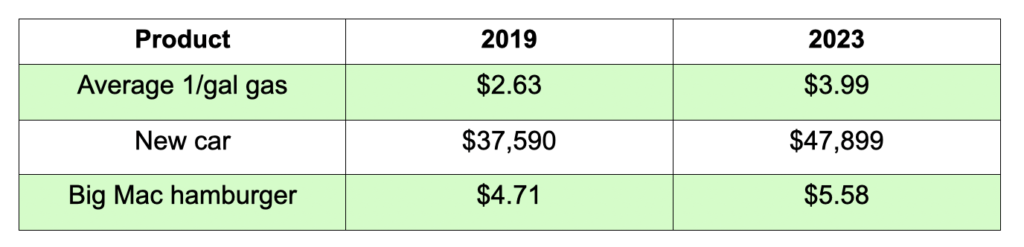

There’s one conversation that every financial advisor should have with their clients. A conversation that should also be explored by reverse mortgage professionals with every potential borrower. Inflation. Questions such as “How are you coping with the higher price of everyday goods and services you’re paying today?” can reveal a cashflow crunch that needs to be addressed.

Continue readingDon’t Believe the CPI ‘Lie’

Undeniable

Here’s why Americans can no longer ignore their economic pain…

Continue readingFiscal Dominance. How the Federal Government is undermining the Fed’s efforts to curb inflation.

The risk of ‘Fiscal Dominance’ and how it would shape reverse mortgage lending…

Continue readingAll locked up! Homeowners struggle to tap equity

Despite holding trillions of dollars in home equity, U.S. homeowners are struggling to tap into it according to a report published by Point, an alternative equity release company.

Continue reading5 Signs of an Impending Recession

Here are the five signs of an impending recession, 4 which we’ve already seen.

Continue readingThe 10-Year CMT: The Curse of Money Printing

The curse of money printing has put pressure on the 10-year CMT and consumer interest rates…

Continue reading