The CPI sleight of hand

Yeah! The consumer price index for January only increased 3.1% higher than one year ago! Is this reason to celebrate? Not necessarily. Welcome to the wretched inflation ratchet- note not ‘racket’ although some may beg to differ.

When it comes to inflation the Federal Reserve’s mandate is to keep the annualized rate at two-percent or lower. This works well in a modestly-expanding economy as long as wages and retirement benefits increase by roughly the same amount. A lower the annual rate of inflation makes it more likely higher wages will offset the difference in the consumer’s purchasing power.

However, after two years of inflation well above the Fed’s target and beyond any Americans wage increases the pain is felt. Many are beginning to ask if inflation is only 3.1% why don’t they feel the ‘improvement’.

The answer lies in the dirty little secret about inflation few financial pundits will discuss.

Welcome to the inflation ratchet

The secret is while the annual rate of inflation has dropped considerably from it’s high of 9.1% in June of 2022, the cost of most goods and services remains well above their prepandemic levels. This has carved out a large part of middle class wealth and decimated retiree’s casfhlow Unfortunately, most consumers find themselves attached to 2021 wages with 2024 prices eating away at their pocketbook.

Much like a ratchet, gains in the rate of inflation are ‘locked in’ with higher prices becoming the new norm. The future growth of inflation is added to the existing inflated cost of goods and services. While the rate of which the ratchet advances may have slowed the higher prices of 2021-2023 become the new baseline for American consumers.

For example, on average Americans are paying 25% more for their groceries. The price of a eggs has fallen from it’s high of $4.82 a dozen in January 2023 but remains 71% higher than they were just three years ago. The price for a pound of bread is 25% higher than it was in January 2021.

But what about the GDP?!

Today, despite the problematic effects of inflation, many financial pundit are touting the positive GDP numbers released earlier this month. While true, the GDP or Gross Domestic Product reveals strong economic output but prices remain stubbornly higher than they were just two or three years ago. So is deflation the answer? Will your $7 latte ever go back to its 2019 $5 price? The answer to both is no.

While falling prices or deflation sounds like an attractive proposition it actually can wreak havoc on an economy. Falling prices can lead to a spike in unemployment and postpone consumer purchases which fuel our economic output. Why buy that new washing machine when it will be cheaper in a few months? In fact, the Federal Reserve prefers modest price increases or inflation averaging an annualized rate of two percent.

How are today’s retire’s faring? Not so well. Even with Social Security benefits being increased thanks to the Cost of Living Adjustments of 5.9, 8.7 and 3.2% in the years 2021-2023 respectively, the aggregate increase of 17.8% while helpful doesn’t fully offset the increased cost of auto, home or health insurance. Should they need a car Kelly Blue Book reports the average auto transaction will cost 6,500 higher than it did in 2021.

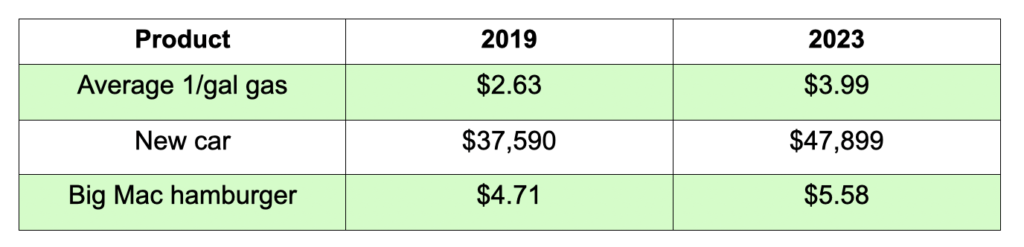

Marketplace.org curated the cost of common everyday goods and found the following price increases.

Again, a slowing annualized rate of inflation only means that the cost of a select ‘basket of goods’ has increased by a given percentage (CPI0 any given month- an increase that’s added to the already baked-in inflated costs of everyday goods and services that remain well above 2020 and 2021 prices.

Another good reason to pick up the phone or contact those homeowners who said “no” just one or two years ago.

No comment yet, add your voice below!