Here are some of the benefits and consequences of the virus that swept the globe three years ago…

Continue readingReverse borrowers encouraged to seek assistance

The office of the California Attorney General Rob Bonta published an alert last week encouraging state residents impacted by the Covid-19 pandemic to seek assistance to repay house payments.

Continue readingA fourth stimulus check for seniors?

A nonpartisan group is asking Congress to issue another round of $1,400 stimulus checks, and this time the payments would go just to older Americans.

Continue readingAs moratoriums end seniors stand to lose the most

As moratoriums end, seniors stand to lose the most

A federal ban on evictions expired Saturday, July 31st. Consequently millions of Americans are facing the specter of housing insecurity or homelessness. The financial protections put in place for millions of households throughout the pandemic including foreclosure moratoriums, stimulus checks, and unemployment benefit bonuses only delayed the inevitable for some.

While the federal government has extended eviction and foreclosure protections multiple times, it’s unlikely we will see another intervention. However, as we are recording today’s show we should note that anything can happen. Case in point- the rapid increase of new cases of the Covid Delta Variant led the CDC to reverse its recent mask guidance for vaccinated individuals. While Covid hospitalizations and deaths had dropped precipitously the government could justify further stimulus and housing protections due to the potential economic impact of the Delta variant strain.

While eviction moratoriums are scheduled to end on July 31st struggling homeowners have until…

[read more]

September 30th to request a mortgage forbearance. Homeowners who obtained a forbearance last spring have up to 18 months of protection. That means someone who entered forbearance last March would exit forbearance this month. Their choices would be to obtain a loan modification, sell the home, or let the mortgage go into default. Those with an FHA, USDA, or VA loan are not required to make a lump sum repayment of missed payments.

The good news is only 2.9% of all active mortgages are over 90 days late reports the Wall Street Journal. That’s a marked improvement from the 4.4% of households who were delinquent last summer. The bad news is roughly 1.55 million are still seriously delinquent and some of those are over the age of 60. Those who stand the lose the most are those who’ve paid down their mortgage balance significantly over the years and have a strong equity position in the property which would be lost in a foreclosure.

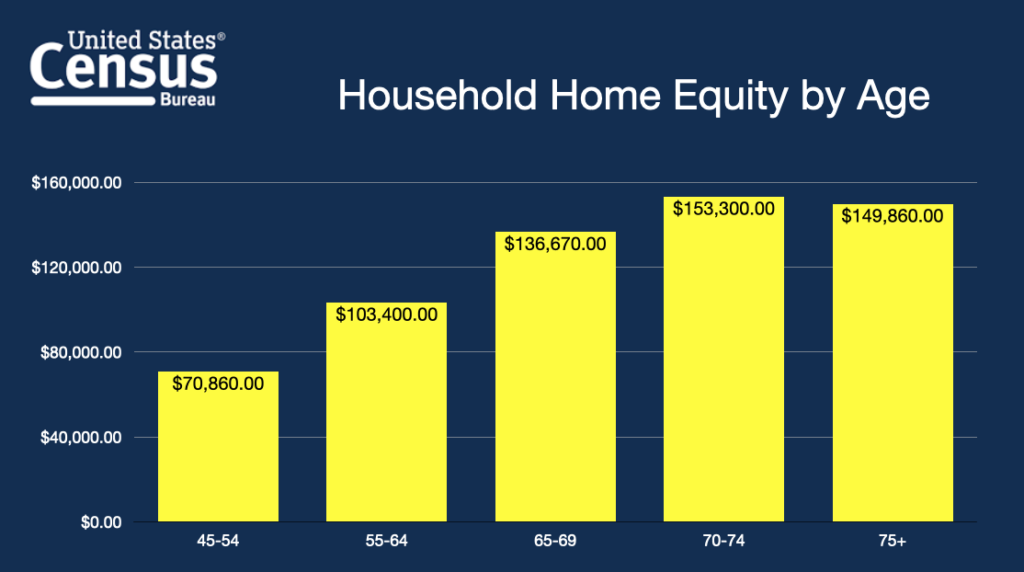

Of all age groups, older homeowners stand to lose the most having accrued significant equity. Census Bureau data shows households aged 45-54 have an average of $70,860 in equity totaling 64% of their net worth. Those aged 55-64 have $103,400 in equity for 61% of their net worth. Homeowners between 70 and 74 have $153,300 in home equity totaling 72% of their net worth. That spells trouble for the struggling homeowner who is delinquent on their mortgage and the opportunity for many to escape potential eviction with a reverse mortgage. This data also confirms that the banks stand to profit the most by foreclosing on older homeowners with substantial equity.

All things considered, we can conclude the following outcomes are likely- There will be a spike in foreclosures across the country, how big we don’t know. Those foreclosures will impact housing values and stand to improve existing home inventory. We can also expect further government intervention and stimulus, especially considering the strong reactions to the Delta variant despite vaccinations. Those emergency measures when added to previous protections will come at a significant economic cost- one that older American’s are ill-suited to absorb.

Moratoriums are winding down and struggling older Americans stand most at risk of losing their accumulated home equity. That’s where you, our viewers, as reverse mortgage professionals can offer a potential remedy to restore housing and financial security.

[/read]

Negative Interest Rates?!

Negative Interest Rates?! It’s not what most think

Negative interest rates? You heard that correctly. No, you don’t have to turn up your volume. In fact negative interest rates in the U.S. are here. (CNBC article). While you most likely will not see this economic anomaly mentioned on your local or national evening news, financial outlets have assiduously reported on central banks around the globe who are now pulling out all the stops in the effort to stimulate the economy. The European Central Bank, Sweden, and Germany currently are in negative interest rate territory and the U.S. may follow.

Does this mean the banks will pay you to borrow money? Not quite.

[read more]

Negative interest rates penalize banks for hoarding cash reserves instead of lending to consumers and businesses and earning interest income. It’s an unusual economic tool and a rare one at that. So closer to home- how will this impact our industry and older homeowners?

Savers and older retirees stand to feel the immediate impacts being unable to count on interest earnings to offset inflation. That could conceivably increase demand for alternative sources of cashflow such as a reverse mortgage. Last Monday the 1-year US Constant Maturity Treasury rate was just .10% or one-tenth of one-percent! The 1-month LIBOR index was a mere .157% and the SOFR (Secured Overnight Financing Rate) was just .09%. Let’s assume the base index for the federally-insured reverse mortgage fell below zero percent. What impacts would existing borrowers see? First, their principal limit or line of credit growth rate would slow significantly- but not altogether thanks to the lender’s margin in the loan. Something to keep in mind when touting the benefits of future borrowing power with financial pros and homeowners. Next, future home equity will be consumed at a much slower rate as the loan’s balance grows much more slowly than it would in a normal interest rate environment. Lastly, with the average lender margin hovering around two-percent new HECM borrowers will benefit by being in the lowest interest rate tier of the HECM’s principal limit factor tables bumping up the present three-percent interest rate floor. While the word ‘unprecedented’ has become increasingly popular in the wake of the COVID-19 pandemic, the truth is negative interest rates have been employed on a few occasions.

And speaking of rates, Ginne Mae- the issuer of HECM Mortgage Backed Securities has provided a reprieve of sorts. In September our industry found itself somewhat caught off guard when Ginnie announced that any HECM mortgage-backed securities tied to the LIBOR index would not be accepted for any HMBS received on or after January 1st, 2021. That news came as a surprise as NRMLA was in active discussions Ginnie Mae, HUD and others on what replacement index would be used for future HECM loans. The good news is the deadline has been extended to March 1st. As RMD reported, “Ginnie Mae did contact the [reverse mortgage] industry, the members of which provided us with additional feedback relating to the volume of applications received by the initial publication date,” a Ginnie Mae spokesperson said.

[/read]

I Survived COVID-19

I Survived COVID-19

The tale of one ‘fluffy’ middle-aged man in the age of the modern plague

[4-minute read]

Stoicism holds a particularly strong appeal. Perhaps because it pushes me toward embracing uncomfortable realities. One of the more pragmatic comments I made this year was, it wasn’t ‘if but when’ I would contract the novel coronavirus. Seeing the early signs of what I believed was certain to become a pandemic emerging from China in mid-January I began my preparations.

I certainly didn’t starve myself to drop weight, but I did take some practical measures to give myself a fighting chance should I contact the infection. As one friend who caught the virus told me, “if you’re not cheating you’re not trying”. The strategy was to make my system inhospitable for any virus, much less COVID by taking a strategic set of vitamin supplements every day. It was the prudent choice having had a long history of childhood bronchitis and a few bouts of bacterial pneumonia, one that left me gasping for air 7 years ago. Would it guarantee a result? No. However, having a vitamin deficiency is to begin at a disadvantage.

Now before you go any further know this- I’m not a doctor but I dress like one when I don my snazzy surgical mask when shopping or in an indoor public space. That said, always seek the advice of a medical professional before undertaking any regimen.

As the annual tradition of the Super Bowl neared I finalized my daily ‘winning set’ of vitamins.

- 50mg of Zinc

- 4,000 IU Vitamin D3 (this is NOT the USDA recommended amount)

- 3,000 mg Vitamin C

Not included are my daily allergy pill, B-vitamins, and antacid.

In February a relative in Southern California was exposed to the virus working out. As a result, I decided to stop going to my crowded gym and instead began a 1-hour cardio regiment through a nearby nature preserve.

Each Sunday afternoon I reloaded my arsenal of vitamins into a prescription box with my virus-kicking power combo hoping for the best when that appointed day should come.

That day was Friday the 13th, November 2020. How ironic.

That evening after concluding an evening Zoom session with a group of friends who I typically met in-person each week, I noticed something quite odd. I couldn’t smell much. As a test, I sprayed some of my trusty cologne onto my fingers, rubbed them together, and held them directly under my nostrils. “Sniff, sniff”. Nada- nothing-zilch. I had absolutely zero sense of smell! It was a clear and sobering sign that I had likely contracted COVID-19. Oddly enough I had already scheduled a test two days earlier for that Sunday having been potentially exposed the prior week. How fortuitous.

Test or no test I sprang into action. I doubled my zinc and vitamin D3 doses and forced myself to do something I hadn’t done in decades- get over 8 hours of sleep throughout the week. After all, a rested body is best suited to fight an invading pathogen.

As the days passed nine-months of terrifying COVID-19 news segments replayed in my head. I anxiously waited for the other shoe to drop. Would I go into respiratory distress? Would there be other complications? Would this be worse than the bilateral pneumonia I suffered in 2013? Should you ever contract COVID know this- you must fight to keep your emotions in check. In addition to a virus, there’s a pandemic of fear that can induce your body to make itself sick. One particular evening, a sense of foreboding fear washed over me. My lungs began to tighten and even feel congested. Minutes later after telling myself that perception isn’t always the reality- the symptoms faded never to return. One thing that finally did return 5 days later was my test results. The PCR exam was positive for COVID-19. To be honest it was a relief to know I was one step closer to putting this episode behind me.

As the days passed nine-months of terrifying COVID-19 news segments replayed in my head. I anxiously waited for the other shoe to drop. Would I go into respiratory distress? Would there be other complications? Would this be worse than the bilateral pneumonia I suffered in 2013? Should you ever contract COVID know this- you must fight to keep your emotions in check. In addition to a virus, there’s a pandemic of fear that can induce your body to make itself sick. One particular evening, a sense of foreboding fear washed over me. My lungs began to tighten and even feel congested. Minutes later after telling myself that perception isn’t always the reality- the symptoms faded never to return. One thing that finally did return 5 days later was my test results. The PCR exam was positive for COVID-19. To be honest it was a relief to know I was one step closer to putting this episode behind me.

In the end, I was extremely fortunate. While my smell has yet to return my worst symptoms included a few weeks of intermittent fatigue but not quite enough to keep me completely away from exercise or chores. However, sadly many of us have lost friends or family to the disease or have seen some hospitalized. It’s important to remember that everyone’s experience is unique.

You may be asking what about your family? To respect their privacy I’ve omitted specific details. However, everyone in our home did contract the virus- some, unfortunately, exhibiting ‘super-charged influenza’ symptoms. Today, everyone is healthy and thriving once again.

Just as everyone who contracts the virus wasn’t necessarily careless, each individual’s reaction and severity of symptoms will vary widely with little apparent rhyme or reason. Outside of self-care the randomness of severe symptoms seems to point to the human genome.

In the near future, you will likely know someone who has become infected. If so, encourage them to not give in to negativity and fear. Even better, if you’ve recovered from COVID-19 you may have the opportunity to donate convalescent plasma to your local blood bank which could help critically ill members of your community. Many blood banks are testing for antigens at no cost.

Someday, COVID-19 will be behind us. However, fighting fear while protecting and caring for your family, neighbors, and friends is a never-ending mission.

Stay healthy. Stay positive. Be Smart.

Shannon Hicks.

Podcast E646: How COVID vaccines could upend the housing market

Unable to use the embedded player? Listen here.

How COVID-19 Vaccines will Upset the Housing Market

The coronavirus pandemic has dramatically changed the landscape of the housing market- especially in urban areas. Here’s how COVID-19 vaccines in 2021 are poised to upset housing trends once again.

Other Stories:

-

COVID has slowed but hasn’t stopped FHA’s search for a new servicer

Podcast E642: A Biden Presidency? Here’s what we may expect

Unable to use the embedded player? Listen here.

A Biden Presidency? Here’s what we may expect

The Hill reports than long-time reverse mortgage critic, U.S. senator, and former co-sponsor of the legislation that created the CFPB is making her interest known in serving as Treasury Secretary in Biden administration should the Democrats prevail in the general election.

Other Stories:

-

Should a 2nd counseling session be required after closing?

5 Ways to Prepare Seniors for the ‘2nd Wave’

[3-minute read]

A second wave of COVID-19 seems imminent. While mortality rates have dropped dramatically seniors may shelter in place again. How can you prepare yourself and your business?

The nation has ‘flattened the curve’ of coronavirus hospitalizations but new cases are on the rise in many states. Yet life is beginning to return to normal with offices, restaurants, and retailers opening their doors months after shuttering their doors. Two forces have altered the gravity of our national economy and the mortgage industry- the media and infectious disease experts. Experts have warned that a second wave of the dreaded virus may arrive in November and possibly linger through the flu season and into the new year.

Being the most vulnerable demographic older Americans are rightly concerned about such forecasts and consequently may choose to return to the relative safety of their homes. Some may find themselves unable to work from home. A recent brief published by the Center for Retirement Research finds that 55 percent of older workers do not have the means to work remotely and many may “face re-entering what they view as unsafe work environments”. A valid concern especially for those whose job entails close contact with customers.

From this we can draw two conclusions:

- Older workers may find themselves in a financial crunch unable to safely return to work

- Many retired homeowners will avoid face-to-face meetings or office appointments fearing exposure to the coronavirus.

All which means whether a second wave emerges or not now is the time to…

[read more]

now is the time to retool our means of engaging potential borrowers. Mike Floth, president of this show’s sister company Reverse Focus said in a recent interview with Reverse Mortgage Daily, “We’re in a position that is really exciting because we have some tips and tricks up our sleeves, we do have some ideas that we can share”. One of those ideas Mike has shared is the use of both teleconferencing and email communications software that bridges the gap in remote sales creating a personal connection.

“Of course, Zoom is a buzzword now. Everyone’s using Zoom,” Floth says. Zoom’s popularity exploded in the early spring as Americans found themselves isolated from coworkers, friends, and family members. “It’s always been big, but now Zoom is everything. Another one is Loom, which is a very simple point-and-click screen recording software that also records video while you’re presenting your computer screen.”

So how can lenders and originators prepare? Here are a few points to consider.

- Check on the welfare of your existing clients. Do they have the means to get groceries or have them delivered? Is there a family member in the area who is willing to assist them? Can medications be delivered?

- Ask previous borrowers if they are current on their property charges such as property taxes and insurance. Do they need assistance? If so help them contact the loan servicer.

- Decide if your office will be offering in-person visits to prospective borrowers and if so, how you will implement safety measures. Market your safety protocols and plans vigorously.

- Train yourself and your team members on how to use remote engagement technologies such as Zoom, Skype, Google Meeting, Loom, or Bomb Bomb.

- Advertise locally in print and online where seniors ‘congregate’.If there’s one silver lining in the age of ‘social distancing’ it may be that many homeowners who found in-person meetings or phone sales intimidating may embrace remote sales as a less threatening and low-pressure means of working with a reverse mortgage professional.

The following is adapted from the June 15, 2020 show script of the Industry Leader Update.

Written and produced by Shannon Hicks ©2020- HECMWorld

[/read]

Hey! How are you?!

[2-minute read]

“Hey. Remember that time when we met and talked about a reverse mortgage 3 years ago and you said no? Do you want to talk again?” That approach would be somewhat believable if it were from a Saturday Night Live skit. No reverse mortgage professional with a functioning cerebral cortex would ever utter such words. However, it’s easy to find oneself saying something that while less abrasive, pretty much reflects the same sentiment- ‘you said no and I can still help you’.

While you typically ‘think in reverse’ 16 hours each day your previous potential borrowers do not. In fact, count yourself lucky if they even remember your name. For the handful of you reading who kept in touch with newsletters, birthday cards, or phone calls- congratulations. [read more]

Our once-normal lives are changing at warp speed. Many older homeowners could find themself facing a financial crisis after being laid off or no longer receiving dividend income from their stocks. Would these unfortunate events cause them to think of you first, pick up the phone, and spill out their problems? In rare instances yes, but not likely.

And this is where a better approach gets you in front of an informed, motivated, and qualified prospective borrower. Here’s one example.

“Hello, Mrs. Hayes. This is Shannon. We met last August. Yes, before the coronavirus. How are you? The reason for my call was to check in and see if anything has changed for you since we last spoke.” Briefly mention any important facts they shared during your first meeting.

After that, it’s your turn to actively listen and take notes.

They may say ‘not much’ or ‘nothing’ in reply to your query. They may explain that they’re concerned they’ll run out of money because of the virus’ impact on our economy. Regardless, there are three things you’ll want to say. First, interest rates are at historic lows which means they stand to qualify for more money. Second, home values may be at their peak which increases their ultimate cash benefit. Third, ask how they feel about their accumulated home equity? Do they consider it to be safe? In an ideal world, what would they like to do with the equity that’s grown over the years?

If they insist they don’t need to further explore a reverse mortgage, ask them if they know anyone over 60 who may benefit.

You may have noticed that this ‘check-in’ call gives you the opportunity to ask open-ended questions and listen to learn what financial pressures they face. Keep it casual and empathetic. Your two goals are to actively listen and then schedule a follow-up meeting (in-person or remote) to explore a reverse mortgage when suitable.

[/read]