As moratoriums end, seniors stand to lose the most

A federal ban on evictions expired Saturday, July 31st. Consequently millions of Americans are facing the specter of housing insecurity or homelessness. The financial protections put in place for millions of households throughout the pandemic including foreclosure moratoriums, stimulus checks, and unemployment benefit bonuses only delayed the inevitable for some.

While the federal government has extended eviction and foreclosure protections multiple times, it’s unlikely we will see another intervention. However, as we are recording today’s show we should note that anything can happen. Case in point- the rapid increase of new cases of the Covid Delta Variant led the CDC to reverse its recent mask guidance for vaccinated individuals. While Covid hospitalizations and deaths had dropped precipitously the government could justify further stimulus and housing protections due to the potential economic impact of the Delta variant strain.

While eviction moratoriums are scheduled to end on July 31st struggling homeowners have until…

[read more]

September 30th to request a mortgage forbearance. Homeowners who obtained a forbearance last spring have up to 18 months of protection. That means someone who entered forbearance last March would exit forbearance this month. Their choices would be to obtain a loan modification, sell the home, or let the mortgage go into default. Those with an FHA, USDA, or VA loan are not required to make a lump sum repayment of missed payments.

The good news is only 2.9% of all active mortgages are over 90 days late reports the Wall Street Journal. That’s a marked improvement from the 4.4% of households who were delinquent last summer. The bad news is roughly 1.55 million are still seriously delinquent and some of those are over the age of 60. Those who stand the lose the most are those who’ve paid down their mortgage balance significantly over the years and have a strong equity position in the property which would be lost in a foreclosure.

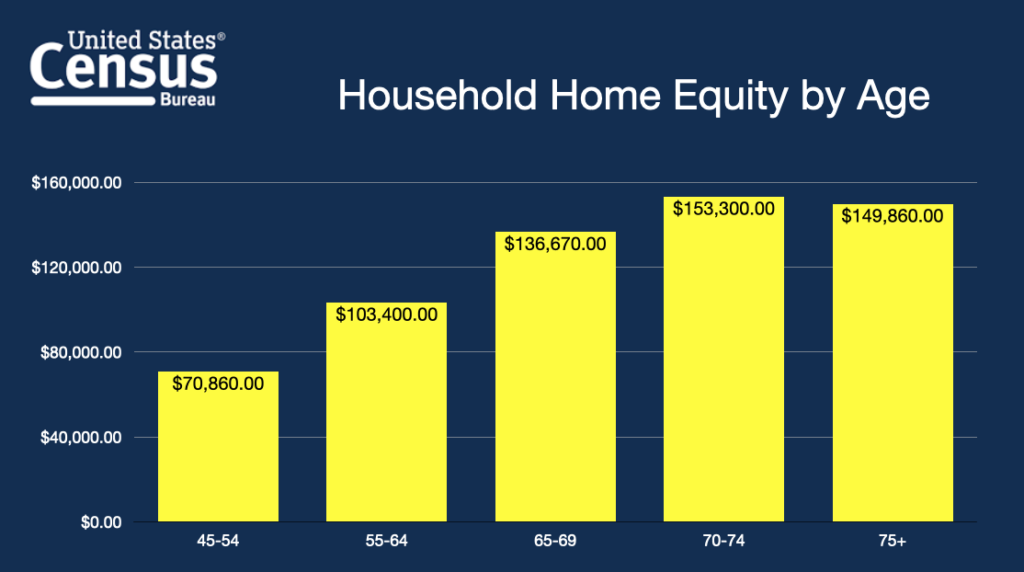

Of all age groups, older homeowners stand to lose the most having accrued significant equity. Census Bureau data shows households aged 45-54 have an average of $70,860 in equity totaling 64% of their net worth. Those aged 55-64 have $103,400 in equity for 61% of their net worth. Homeowners between 70 and 74 have $153,300 in home equity totaling 72% of their net worth. That spells trouble for the struggling homeowner who is delinquent on their mortgage and the opportunity for many to escape potential eviction with a reverse mortgage. This data also confirms that the banks stand to profit the most by foreclosing on older homeowners with substantial equity.

All things considered, we can conclude the following outcomes are likely- There will be a spike in foreclosures across the country, how big we don’t know. Those foreclosures will impact housing values and stand to improve existing home inventory. We can also expect further government intervention and stimulus, especially considering the strong reactions to the Delta variant despite vaccinations. Those emergency measures when added to previous protections will come at a significant economic cost- one that older American’s are ill-suited to absorb.

Moratoriums are winding down and struggling older Americans stand most at risk of losing their accumulated home equity. That’s where you, our viewers, as reverse mortgage professionals can offer a potential remedy to restore housing and financial security.

[/read]