A proposed CFPB rule would provide homeowners with increased foreclosure protections.

Continue readingWhat a Chief Appraiser does and why it matters to you.

Watch our exclusive interview with Atlas Valuation’s new Chief Appraiser Joe Pravettone.

Continue readingAppraisal bias protections and the HECM

Appraisal bias protections are extended to HECM applicants who may request a…

Continue readingInflation is back! What retirees can expect

What you thought you could live on in retirement may cost quite a bit more thanks to inflation…

Continue readingIs there an appraiser shortage?

This week we interviewed Chief Appraiser John Dingeman with Class Valuation asking what’s truly slowing down appraisal turnaround times…

Continue readingThe Appraisal Crunch

Unable to use the embedded player? Listen here.

EPISODE #689

The Appraisal Crunch

Both reverse and traditional mortgage originators are feeling the crunch of appraisal turnaround times. RMD explains why and what HECM professionals have to say.

Other Stories:

-

The RMI Reverse Market Minute update

-

Us Existing-Home Sales Fell For The First Time In Over A Year, Price Growth Slows

FHA’s 2nd Appraisal Rule Raises Questions:

Commentary: The HECM Collateral Risk Assessment:

Last week ended with a bang. Just as many prepared for the weekend anticipating the rare gift of an October without additional HECM changes- another mortgagee letter dropped late Friday morning. Enter the October Surprise– the Collateral Risk Assessment.

For those of you unfamiliar with this development the Federal Housing Administration announced that all appraisals for Home Equity Conversion Mortgages will be subject to a review under the Collateral Risk Assessment. If said assessment finds the values are ‘inflated’ a second appraisal must be ordered. The agency made the move having found 50,000 HECM loans out of 134,000 (37%) run through their automated valuation model (AVM) were inaccurate by at least 3%. The formulas and standards used in the risk assessment will be kept under wraps to preserve the integrity of the process and ensure that the market does not respond in kind skewing the results.

Unlike any other HECM mortgagee letters that preceded it, Mortgagee Letter 2018-06 includes a sunset provision stating an evaluation of the new protocol will be made six and nine months after enactment to “determine if the goals of the guidance have been met”. The subtext could be read as stating, ‘we hope this works. If not, we will try something else’. How the agency will measure the effectiveness for new loans written in the same year that have not terminated remains to be seen.

Barking up the right tree

To be fair, HUD and the FHA are rightly concerned, as they should be, on the valuation of HECM properties. After all, reverse mortgages are collateralized loans heavily dependent on the ultimate value of the home securing the loan when the HECM terminates. If you start too high you’re setting yourself up for serious problems down the road. Fair enough.

As FHA examined HECM loans from the years spanning 2008-2010, it’s not surprising that 37% revealed problematic or inflated appraisals. Homes appraised during this period would reflect some of the most volitile values prior to the crash and include the rapid depreciation of most properties. Even by 2010, some properties had not fully reached their market low. It would be enlightening to see the results if the more normative years spanning 2015-2017 had been used instead.

Are inflated appraisals the true underlying issue contributing to continued losses or is it the assumed national appreciation rate of 4% that’s baked into the HECM program’s formula? It’s a sincere question that warrants closer examination. I would argue the later. It could be said the FHA is barking up the right tree, but perhaps not at the right branch.

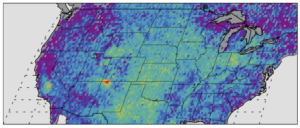

The need for Geo-Centric PLFs

Providing homeowners access to the same percentage of funds (PLFs) in an area that has consistently fallen below the assumed 4% annual home appreciation rate makes no sense. Under the present rules, borrowers in markets with little or no appreciation pose a clear and present danger to FHA’s mutual mortgage insurance fund. Perhaps more so than a small percentage of properties with somewhat inflated appraisals.

For years a small group of HECM professionals and myself have argued for geo-centric principal limit factors which would be adjusted to the specific real estate market. Lower or negative historic appreciation rates would result in lower PLF tables. Just as all real estate markets are uniquely local, so should be the risk management measures taken. Yes, it’s a politically incorrect and socially problematic approach, but one that should be seriously considered to curb future losses. After all, unlike its traditional mortgage counterpart, HECMs are exceptionally sensitive to appreciation and future values having no regular loan payments to reduce risk. In addition, a heat map showing the concentration of HECM claims paid from FHA would be helpful in identifying any localized trends to be used in shaping future policy.

A glancing blow

While a required second appraisal in some instances is a significant setback for many, it’s not as a significant blow such as PLF reductions which substantially reduce funds made available for all HECM borrowers. The leadership at the Federal Housing Administration are working in earnest to isolate the source of continued losses from reverse mortgage loans. In fact, the FHA’s Commissioner Brian Montgomery said the agency is working on another upcoming change but did not specify the details. The question is, are we getting closer to the target?

BREAKING- New Collateral Assessment may require 2nd appraisal

FHA’s New Collateral Risk Assessment will require a 2nd appraisal when determined that 1st appraisal is ‘inflated’

BREAKING- FHA announced today the enactment effective October 1st that all HECM loans must undergo a Collateral Risk Assessment to determine if the first appraisal is inflated or at market values. If it is determined that the appraisal exceeds the assessment’s guidelines, then a second appraisal will be required which can be financed into the closing costs of the loan. Read the mortgage letter