The data is in. Over 10 million 65+ homeowners still have a mortgage- many may need relief…

Continue readingAn avoidable tragedy

Don’t let those on the edge of eligibility fall through the cracks

Sadly many tragedies are preventable. Tens of thousands of older homeowners are on the edge of financial collapse due to their rapidly-dwindling purchase power and fixed income. Perhaps they’re just getting by today but who’s to say they’ll be able to financially survive two years from now? The tragedies that sting the most are those we could have avoided.

While the real estate market and interest rates have radically changed the HECM program has remained relatively unchanged in recent years. However, one thing has changed considerably -the 10-year Constant Maturity Treasury rate to which federally-insured Home Equity Conversion Mortgages (HECMs) expected rates are keyed.

Since November 2018 the US 10-year Constant Maturity Treasury (CMT) steadily declined until it hit a pandemic low of .54 percent in March of 2020- the same month when the median listing price of a home was $322,000. By March 2022 the median price has surged 26% to $405,000 and the 10-year CMT had increased over three-fold to nearly 2.5%. As of June 13th, the 10-year CMT rate is 3.09%.

The rapid increase of the 10-year CMT not only diminishes the funds a HECM borrower may qualify for but also reflects the surge in the 30-year fixed-rate mortgage rate which is softening buyer demand and putting pressure on home listing prices in several markets. Higher rates and slipping home values mean the window of opportunity is closing for many homeowners who previously inquired about the loan.

Here are 5 ways to find and reengage with prior reverse mortgage prospects.

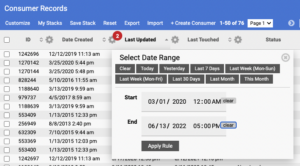

- Search in your CRM for a date range for records you haven’t opened in the last two years. Sales Engine CRM by Reverse Focus makes such a search a snap.

Sales Engine CRM’s powerful search function - Research the cities or regions where home sale prices are dropping or have already begun to decline. Use your CRM search for records with no sales in these areas.

- Schedule two hours each week to personally call each of your previous contacts who were potentially eligible for a reverse mortgage. Check in and let them know you’re reaching out considering the recent changes in interest rates and the housing market.

- Create an email series (drip-marketing). Make sure you don’t fatigue them with too many emails in a period of time. Typically, one email every 3 to 5 weeks should not annoy people to the point of unsubscribing.

- Get an SEO landing page for a specific region where home values and typical mortgage balances provide more potential reverse mortgage borrowers. This is a great way to target specific markets you’ve researched- especially if you’re using RMI’s Dashboard tool.

At this very moment, the window of opportunity is closing for those who previously inquired about a reverse mortgage. Don’t let them miss out just because they were not reminded that they may have an option to doing without. And don’t miss out on building your loan pipeline while helping older homeowners improve their quality of life in retirement.

Give Up & Give In?

Giving Up & Giving in are immediately seen as negative but let’s look at it from another angle…

Continue readingLenders see business uptick in wake of big bank exits: Industry Leader Update

[vimeo id=”28432975″ width=”601″ height=”338″]

Remaining lenders are seeing something they’ve always wanted…

an increase in referral phone calls from non-reverse banks and financial professionals. Many of these referrers had sent their clients to Wells Fargo & Bank of America based on their well known brand and geographic convenience. Today reverse mortgage originators have a unique opportunity to step in and provide an attractive solution for senior service providers. Many lenders are already seeing the phone ring from those who had referred to Wells & B of A in the past looking to remaining lenders.