When it comes to leads the most popular discussions center on what’s the best type of lead. The merits of lead sources could be debated endlessly since there are a variety of factors that come into play and all salespeople are not created equal. Assuming you are already purchasing or committed to buying reverse mortgage leads have you ever asked “Which leads convert faster?”. In other words who is more likely to become a closed loan more quickly?

Lenders using the call center (centralized model) often field lead inquiries from both television and the internet. So who converts to from a prospect to a bonafide borrower more quickly? Internet leads. Television leads give great exposure and often motivate the mildly curious to call requesting more information. It’s more of a precursory look into the product with little commitment on the part of the viewer. Contrast this with leads from the internet. These trend toward serious prospects who are looking to make a decision in the near future and they are committed enough to enter in some basic personal information.

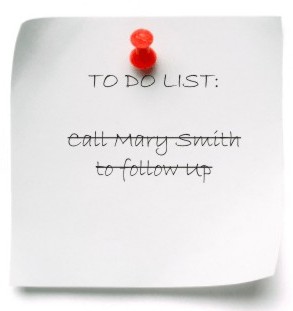

Both internet and television leads have there place in an overall marketing plan but care and attention should be given to the timeframes of investment and return. Successful marketers not only purchase one campaign, but several knowing their lead conversion ratios and future income. Another key element is tracking and followup. Disciplined use of a CRM (Customer Relationship Manager) is key in nurturing leads into closed loans.

Both TV and internet are effective lead generators. The trick is to draw from both and execute your own carefully thought out marketing and follow up plan. What’s your plan for leads in 2013?

If you’ve ever purchased

If you’ve ever purchased