Here’s why an increasing % of Americans are taking early withdrawals from their retirement savings…

Continue reading4 Ways Older Americans are Hurting Financially

It’s no surprise that older Americans are one cohort disproportionately impacted by high inflation and rising interest rates. Here are 4 ways…

Continue readingBad Words

Words must be precise and accurate, especially in reverse mortgage lending.

Continue readingHow to Create Happier Holidays for Seniors

The following article originally appeared on HECMworld in November 2018

This time of year is marketed as a Hallmark movie, with smiling scenes of happy families and voices lifted in song. Yet for many older people who have lost their spouse, or who may be facing health or financial challenges, the holidays tend to exacerbate feelings of aloneness.

Grief can intensify around the holidays as well, particularly if this season is associated with loss. End-of-life issues expert Michelle Peticolas says grief is a physical experience as much as an emotional one and needs to be addressed as such:

“Significant loss impacts the brain. The neural network pattern associated with a particular attachment — person, animal, object, identity, etc. is broken. It’s a little like a computer hard drive that freezes. The reality that a long-held attachment is gone simply does not compute.

“The pathways that previously led to pleasure, comfort or love now lead to an abyss. It takes time for new brain pathways to replace the old, to develop a new pattern.

“The first order of business in navigating the physicality of grief is patience, just as one needs patience in healing a broken bone. A new physical structure is being built and this will take time.

“As with a broken bone, there are actions that can reduce the suffering and support the healing. Sleep and healthy eating are essential to any bodily repair. Exercise also heads the list because in addition to boosting the immune system and filling the body with ‘feel good’ endorphins, it provides the body with a whole array of physical stimulation that supports brain development while renewing those pathways that are still intact.

“Focusing on the body can provide relief and release from grief energy that builds up in the body. Things that stimulate the senses, like sound, music, touch, physical movement, taste, aroma, and visuals all help to bring attention into the body. Being in the body takes the mind out of the flow of time — away from longing for the past and/or catastrophizing about the future. It is a temporary respite but a healthy one. It gives the nervous system a break from the emotional flood that grief can bring while supporting the physical healing of the mind.

“There are also times when any stimulation may be more than the brain can manage. In this case, activities that are soothing, relaxing and evoke a feeling of safety and support tend to work best. Essential oils, hot baths, massage, being held or hugged by a trusted person are possible choices. Sitting in the sun, or walking in the forest are also good.

“Create a list of activities to rely on when unhappy or distressed. Put items, such as an essential oil or pictures of items, e.g. photo of the woods, with the list into your first aid kit for grief care. It can be an empowering action at a time when one feels quite helpless.”

For reverse mortgage professionals, the simple act of smiling at your senior client — even over the phone; the smile comes through in your voice — can have a huge, positive impact. One longtime LO says, “When I’m in a store and make eye contact with complete strangers in passing (women as well as men) with a relaxed countenance and a smile, they always return the smile, often with a nod. I can walk into a room on any occasion and start a conversation within a minute. The point is being open and approachable. Some people can’t do this. Those of us who can, and choose to, find our days are more pleasant and less stressful…plus we open ourselves to learning experiences and new activities from new acquaintances.

“We need to help older adults who may be alone to think about ways they can broaden their friendship base and learn to enjoy new activities they may not have explored previously, and a smile is a way to start.”

One of my favorite smile-inducing videos is Validation. This is all we really need from one another: to be validated in our everyday encounters. A reverse mortgage professional who shows a client true interest and care is halfway home. Happy holidays.

Being a Happy Realist in the HECM Marketplace

Realistic Optimism?

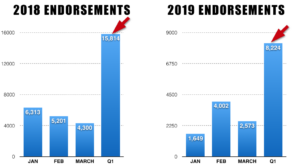

No matter how you slice it, HECM endorsement volumes are down- significantly. The first quarter of 2019 has

48% fewer endorsements than Q1 2018. Even when factoring in the lagging endorsements from the late 2018 rush to beat October 2, 2017, HECM changes– the trend is undeniable. HECM volumes have broken their previous cycle of ‘secular stagnation’ with drops and rebounds as a new trend appears.

While the October 2017 cutbacks to the HECM’s principal limit factors and dropping the interest rate floor may have reduced the program’s risk to the MMI Fund, they have also prompted an extended slump in HECM lending volumes.

What may frighten and dismays us may not be our industry’s falling loan volume, but the way in which we think about it.

A number of factors may be contributing to fewer HECM endorsements should be kept in mind:

- A reduction in Principal Limit Factors (10/2/17)

- A reduction in the interest rate floor (10/2/17)

- Attrition in the HECM salesforce (originators/brokers)

- Internal beliefs by originators on the value of the HECM for the consumer

- Fewer marketing dollars to invest

- An uptick in jumbo reverse mortgage loans

- Increasing mortgage debt held by older homeowners

The good news is that the vast majority of older American’s wealth is tied up in their home- which means policymakers will have to find a way to sustain the reverse mortgage financially while retaining it as a viable solution. Although President Trump’s call to examine the ‘financial viability’ of the HECM program may be just cause for concern, it may be the impetus to finally isolate the true causes of ongoing HECM claims against FHA’s MMI Fund.

Why are they acting so strange?

Understanding Senior Behavior

Children who become caregivers for their aging parents often find themselves facing behavioral changes. Sometimes seemingly overnight, or perhaps occurring more gradually, their once calm, loving parent becomes blunt, even mean — or possibly quite fearful.

Children who become caregivers for their aging parents often find themselves facing behavioral changes. Sometimes seemingly overnight, or perhaps occurring more gradually, their once calm, loving parent becomes blunt, even mean — or possibly quite fearful.

But it isn’t only adult children as caregivers who may notice bewildering behavior. One elderly woman began heaping verbal abuse on a visiting nurse who was attempting to change her husband’s wound dressing, interfering with the process and insisting the nurse was doing it incorrectly.

What causes such shifts in demeanor, and what is the best way to respond? Anyone who works with seniors — including reverse mortgage professionals — needs to be aware of these issues.

When a senior begins acting out of character, the first priority is to rule out an organic cause, e.g., dementia. An abrupt change in behavior, such as a mild-mannered senior suddenly starting to swear or becoming enraged with no provocation, may indicate a change in their mental or physiological state — but it could just as easily signify frustration with the many-layered loss of control that tends to accompany aging.

In the example above, the nurse recognized that her patient’s wife felt excluded and helpless, and took her aside to explain that she understood her feelings, and was there to help her give her husband the best possible care. Once the woman felt “seen”, she calmed down, and the R.N. was able to complete her wound care visit satisfactorily.

Sometimes an elder will be verbally or emotionally abusive to a caregiver, child or other person with whom they feel safe enough to do so. They may not even think they’re being offensive; just venting their pain or grief to someone they trust to “hold” their feelings. So if a senior you know says, “Mind your own business!” a little forcefully, thank them for trusting you enough to be honest, back off from whatever you were discussing, and don’t take it personally.

Of course, if they say this in a reverse mortgage setting, it would be wise to schedule another meeting at a later date to ascertain whether the outburst has any direct bearing on the HECM process — and to assess whether this senior is, in fact, a good candidate to age in place. If so, what additional support services might be needed?

We each grow older differently, yet the aging process, however joy-filled, does by definition necessitate loss. Friends and family members die, people move away, bodies become less agile. Perhaps most distressing of all, the opinions and wisdom accumulated over a lifetime are frequently brushed aside.

The gift you can offer seniors who may be behaving in an unexpected manner is to recognize that it’s not about you, and that, barring any physical or mental impairment, your best response is one of understanding, care, and attention — which may be exactly what the senior is trying, however inappropriately, to obtain.

Ending 2018 on a Grace Note

Year-End Ideas for Your Senior Clientele

In music, a grace note is considered “non-essential,” an ornamental embellishment — yet something about it distinguishes the piece, or the composer would have omitted it. It’s the same with a signature piece of jewelry or a personalized flourish on gift wrap: the effort adds an ineffable, lovely meaning for the recipient.

This time of year can be challenging for seniors and their families alike, particularly if a family member is serving in a caregiving capacity.

Here are some simple ways you can create grace notes to close out the year, as part of your reverse mortgage mission of senior service:

- Reach out, reconnect. Have you kept in touch with your past reverse mortgage clients? How about prospects who didn’t pursue the loan application, or for whatever reason chose to wait? This might be an excellent time to reconnect — not in business mode, but because you care about their welfare and want to know how they’re doing. The phone call or visit will be sure to brighten the senior’s day — and you never know how this caring contact will, in fact, benefit your business down the road. Kindness has a long memory.

- Play Santa. A festive holiday open house is always a delightful way to show your reverse mortgage clients, potential clients, referral resources and friends how much you appreciate them. Hold the gathering during daylight hours in an easily accessible location to encourage your older invitees to attend. If your community provides paratransit or similar senior transportation services, arrange for those you know will need a ride to be picked up, and taken home later on.

- Be a snail. In our digital age, when even nonagenarians are device-adept, it’s a real treat to receive an old-fashioned holiday card in the mail. Buy a box of nonsectarian greetings, and add a personal message before signing your name. For some seniors, this will be the only holiday card they receive — and it will be treasured, Anyone, of any age, would like to be remembered — especially at this time of year, whether they celebrate the holidays or not. There’s an elusive feeling of inclusiveness that permeates the season, and nobody wants to be left out.

- Lend an ear. Community service is especially welcome during the holidays when extra hands and attentive ears are greatly valued. Your local senior center, or a community group that caters to mature adults, will be grateful for any time you can devote to serving their members. Offering a receptive ear for an hour is quite a gift, magnified ten-fold if you’re able to visit someone who is housebound.

- Collaborate and co-create in 2019. This time of year is also a timely moment to reach out to your referral resources and show gratitude for your business relationship. Contact the CPAs, financial planners, tax advisors and other professionals you work with who serve the senior market and offer to hold an informal New Year’s Q&A to update them on HECM changes, as well as educate their staff, clients, and associates.

As you put these ideas into practice, you’ll be playing the grace notes that set your reverse mortgage business apart in an elegant, important way. Happy 2019!

Looking for more reverse mortgage news, commentary, and technology? Visit ReverseFocus.com today.

The New “Nesters”: Not Empty, Not Full, Just Right

In the past, granny units weren’t typically inhabited by grannies. Most such units served as an income source for the homeowner, and were rented out to twenty-somethings who were getting their feet wet in the job market. Or, in more recent economic times, to people of all ages who need an affordable place to live.

But now, tiny houses may become a new senior destination, lending a whole new meaning to the term “downsizing”.

Bill Thomas, MD, who created The Green House model, a new standard in long-term care, envisions these “granny pods” as either accessory dwellings, or actual homes for seniors who want to remain independent, yet near family or other loved ones.

Tiny Houses with a Big Purpose

While the tiny home concept has been around for years, Thomas’ prototype includes smart home features and universal design elements to make the tiny home safe and secure for seniors.

Although a tiny house likely won’t qualify for a reverse mortgage due to its portability — and probable lack of comps for an accurate valuation — a HECM client can use part of their loan to invest in a senior-suited tiny house, and potentially use this “turtle shell” for retirement travel.

Thomas originally developed his prototype, the Minka, for his adult daughter, who requires round-the-clock care due to a neurological disorder. Throughout 2018, the University of Southern Indiana has been testing a version of the dwellings on campus as a multigenerational community housing model, uniting health professions with other disciplines, such as social work and engineering, in an effort to change the way society perceives aging.

The year-long pilot program, known as MAGIC (Multi-Ability, multi-Generational, Inclusive Community) which also garnered support from AARP, is helping Thomas and his team develop a model framework for building multi-generational, inclusive communities where students from a variety of disciplines work, live and study in close proximity with older adults, with a focus on fostering what he calls “independence together” through social and physical activities and healthful eating.

While we’ve explored how students in the Netherlands live free in nursing homes in exchange for befriending elderly residents, as well as the cohousing model that has even been adapted specifically for the senior market, tiny homes that address multiple abilities is a truly visionary concept.

Nesting with Independence

In fact, Nest, Google’s smart home automation division that is renowned for its “nested” thermostats that can be remotely adjusted from anywhere in the world, and home security systems that allow family members to check in on loved ones, is exploring how best to tweak its products for aging in place.

Because many older adults prefer not to use products specifically targeted to them, but rather mainstream consumer products that are easy for them to use, moving into the aging market after seeing success with a general population is a promising approach, say aging experts.

Will tiny homes someone can nest into fill a role for empty nesters who seek a living environment that’s adaptable, comfortable, and portable? Keep an eye on this evolving trend. If nothing else, Thomas’s Minka may become the granny unit grannies rent out to others in their cohort group who want to stay in a supportive, cozy, affordable environment when they travel.

**A Note from the HECMWorld Staff:** Tiny homes are still a relatively new phenomenon, and traditional lenders are still adjusting to this recent trend. Mortgage professionals should contact their underwriting department to see if a ‘tiny home’ would meet the requirements of a Home Equity Conversion Mortgage.

From HECM to Hospice: Preparing for Transition

Last week we looked at new ways seniors are demystifying rather than denying death, and how smart pre-planning can help families mitigate conflict once the HECM recipient dies.

What happens when a reverse mortgage client is approaching the end? One option many might overlook for easing their passage is hospice.

For someone with a HECM, hospice care at home may be ideal. In general, patients are spending less time in skilled nursing facilities (SNFs) and more time at home with outpatient care.

Hospice care involves a team that usually collaborates closely with family and other caregivers to create optimal end-of-life care. A hospice team may include:

- The patient’s primary doctor

- Nurses and home health aides

- Social worker

- Clergy or spiritual counselor

- Trained hospice volunteers

- Speech, occupational, and physical therapists

- Bereavement counselors

Of course, a patient who requires extensive medical care and monitoring may be better served in a hospice care center, hospital or SNF. However, if they improve to the point that they no longer require hospice care, they might be able to return home with caregivers. Healing is not an exact science, and people’s lives often take surprising turns.

How Hospice Care at Home Helps A Non-Borrowing Spouse

If someone who is the sole HECM borrower leaves their residence for hospice care in another location and is able to return home within one calendar year, their HECM should not be called due-and-payable, as long as the property and appropriate taxes and insurance are paid on time.

However, if the HECM borrower has a non-borrowing spouse, the issue becomes trickier. Non-borrowing spouse (NBS) protections only apply in the event of the death of the primary borrower. In the case of a non-borrowing spouse named in a HECM, when their spouse passes, the loan’s due-and-payable status is deferred as long as the NBS:

- Continues to live in the home as their primary residence

- Signs and returns the required annual certification of occupancy to the loan servicer

- Maintains the property to HUD standards

- Makes timely property charge payments.

These NBS protections do not apply when (1) the primary borrower is absent from the property longer than six months, or (2) a medical professional has determined that return to the home is unlikely. Each of these events may trigger the loan being called due-and-payable, as they are outside HUD’s NBS protections.

This is why hospice care at home may be the wisest choice when there is a younger (under 62 at the time the loan closed) non-borrowing spouse. Caring for the senior at home protects both residence and residents, while allowing the person who is receiving hospice care to spend their final days surrounded by the people and place they love.

Ways the Family Can Help

When a beloved elder is approaching end of life, it’s hard enough to focus on the tasks leading up to this loss, let alone think about all that will require attention afterwards.

Some key issues family members (or whoever is appointed POA) can set in motion before someone is at this stage include:

- House appraisal, followed by family discussion;

- Inventory of house contents in preparation for an eventual estate sale or online auction;

- Hiring a professional organizer to clear out the house (heirs would be wise to put aside money in advance for this purpose);

- Decision to sell the house or pay off the HECM. If one of the senior’s children or another relative wishes to live in the home rather than sell it, nothing precludes this possibility, assuming they are able to pay off the loan balance. The heirs would have up to one year (with extensions) to sell, or refinance and purchase the home.

- Hire an estate lawyer to create a clear legal agreement about terms, and what happens if someone can’t comply.

Commonly Overlooked Tools for Incapacity Planning

The Office of Chronic Care Advocacy suggests several often- underutilized resources to assist in planning for disability, incapacity, or death:

- Elder law attorneys. Beyond providing the legal documents and tools for effectively coordinating decision-making and financial management, elder law attorneys provide an experienced concierge in areas most people have not confronted, such as coordination of benefits, hiring of supplemental providers, and coordinating financial planning. Further, elder law attorneys focus on the effective implementation of their documents.

- Financial advisors. Building a solid relationship with a financial planner/coach can be an extremely effective way of coordinating assets at death, preventing or mitigating financial exploitation, and budgeting for medical expenses. Financial advisors and elder law attorneys need to be on the same page to effectively coordinate a senior’s legal and financial plans. A financial advisor is also a useful hedge against scammers, because they can place alerts for unusual expenditures, large withdrawals, and other changes in financial behavior.

- CPA. Many individuals think their income picture in retirement is so simple that they do not need a CPA. However, having tax returns filed with a CPA provides a quick and easy place for a substitute decision maker or executor to go in the event of incapacity or death. In addition, individuals who self-file may miss out on important tax benefits available to older clients, such as deductions for long term care premiums and healthcare expenses, and “catch-up” contributions to retirement savings.

- Account coordination. Services and apps have proliferated to coordinate banking, health, and other information. Most banks have created smartphone apps to manage accounts, a great help for a family caregiver. Mobile payment platforms for in-home care services dispense with the need for new caregivers to have access to cash or checkbooks, while delivering instant and direct payment for services with a clear record for tax and other reporting purposes. Most of these services quickly justify their costs in the security, comfort, and protection they provide.

Movin’ On, Part 2: What to Know Before You Go

Movers can make or break someone’s initial happiness. And it’s not just a matter of how well they wrap the china…

Continue reading