Making Sense of it All

When it comes to mortgage lending- reverse mortgage lending, it’s easy to feel there’s not much to celebrate. A slide in HECM endorsement volumes since November 2023 followed by two months (March and April) of modest but notable growth may assuage the discontent many feel but that’s not the end of the story.

Today we examine the key performance indicators of our industry’s overall sales volume and what we may expect in the coming summer months.

Seasonality:

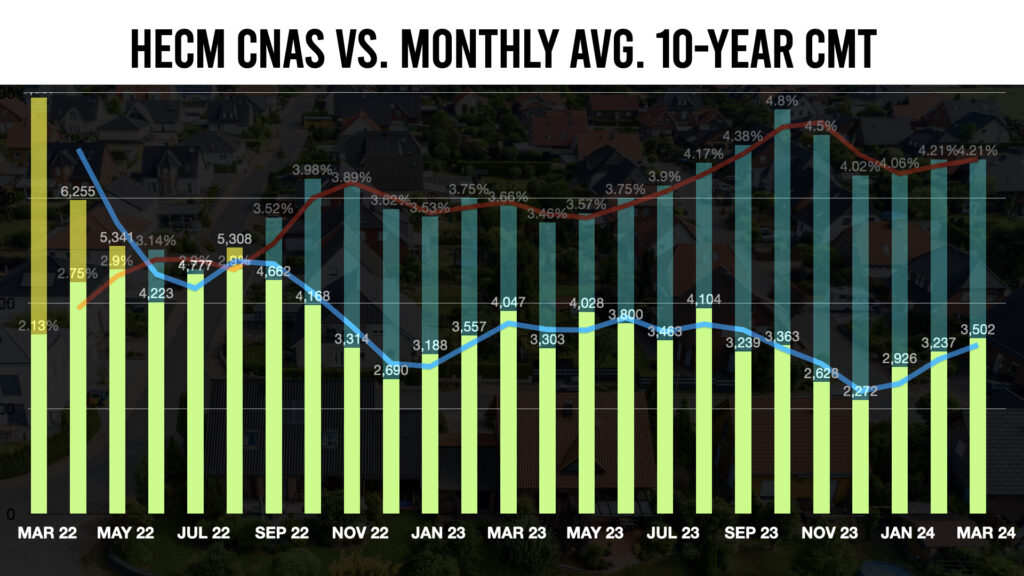

The arrival of Fall brings falling leaves and typically falling HECM application activity. To illustrate this let’s compare the twelve-month periods of March 2022-2023 and March 2023-2024. Each year as the temperatures drop so do case number assignments (CNAs) for new HECM applications assigned an FHA case number. Examining August through December 2023 case number assignments we observe a steady downward staircase that typically reaches its nadir in December. During the same period we see a similar pattern albeit with an uptick in October 2023. The impact of rising interest rates cannot be ignored in 2023 so let’s look to August through December 2018 and we find again a nearly identical trend line as we did in 2023.

The point is that HECM production has shown itself to be prone to seasonal similarities. But here’s the good news.

To view images click to view in a new tab.

Future HECM Endorsement Volume

The latest HECM endorsement volume for April generally pulls from HECM FHA case numbers assigned in December last year. It’s not a perfect science but typically there’s a four-month lag between the time a HECM case number assignment is issued (CNA) and endorsement. Looking back to HECM CNAs in January, February, and March we find month-over-month growth of 18%, 4%, and 14% respectively. This bodes well for increasing endorsement totals in May, June, and July.

Watching the Spread

Final Thoughts

If there’s one thing reverse mortgage professionals are it’s resilient. Take a deserved pat on the back, keep your hand to the plow, and remember that today’s market and economy are unlike any we’ve seen thanks to the lingering effects of a worldwide pandemic.

Chime in the comment section below and let us know your thoughts on this data and be part of the conversation.

Shannon Hicks

Editor in Chief: HECMWorld.com

As a prominent commentator and Editor in Chief at HECMWorld.com, Shannon Hicks has played a pivotal role in reshaping the conversation around reverse mortgages. His unique perspectives and deep understanding of the industry have not only educated countless readers but has also contributed to introducing practical strategies utilizing housing wealth with a reverse mortgage.

Shannon’s journey into the world of reverse mortgages began in 2002 as an originator and his prior work in the financial services industry. Shannon has been covering reverse mortgage news stories since 2008 when he launched the podcast HECMWorld Weekly. Later, in 2010 he began producing the weekly video series The Industry Leader Update and Friday’s Food for Thought.

Readers wishing to submit stories or interview requests can reach our team at: info@hecmworld.com.

2 Comments

The research is interesting but little will change the fact that since October 1, 2018 we have endured the current worst year for HECM endorsements (fiscal year 2019) since fiscal year 2003, the second worst year (fiscal year 2023) for HECM endorsements since 2003, and what has been shaping up as the new worst fiscal year for HECM endorsements (fiscal year 2024) also since 2003. That is three years of poor HECM endorsement volume out of six. Fiscal year 2024 may have less than 30,000 HECM endorsements.

.

What is surprising to most industry observers is that our best fiscal year for HECM endorsements (fiscal year 2022) since fiscal year 2011 (expecting 2003?) was recently declared by HUD to be by far the worst fiscal year as to the Net Present Value of its Future Cash Flows as of 9/30/2023 for any fiscal year accounted for in the MMIF (Mutual Mortgage Insurance Fund). Primarily due to adverse selection, the estimate is a negative $807 million.

.

Despite what many falsely believe, a substantial increase in the HECM endorsement volume does not normally result in more cash to the MMIF. It usually results in negative cash flow.

.

There have been six fiscal years with higher HECM endorsement volume (2006, 2007, 2008, 2009, 2010 and 2011) than that for fiscal year 2022. The first four years of those six were years of increasing HECM endorsement volume when compared to the prior fiscal year. The last two years had falling HECM endorsement volume when compared to the prior fiscal year. H4P has never reached 2,700 HECM endorsements in any fiscal year since its creation in HERA of 2008. HECM Refinances (aka HECM to HECM Refinances) had never reached 9,000 HECM endorsements for a single fiscal year until fiscal year 2021 when that category had 20,584 HECM endorsements. The best fiscal year for HECM Refinances was fiscal year 2022 with 28,749 HECM endorsements. Last fiscal year that total was just 4,001.

The research is interesting but little will change the fact that since October 1, 2018 we have endured the current worst year for HECM endorsements (fiscal year 2019) since fiscal year 2003, the second worst year (fiscal year 2023) for HECM endorsements since 2003, and what has been shaping up as the new worst fiscal year for HECM endorsements (fiscal year 2024) also since 2003. That is three years of poor HECM endorsement volume out of six. Fiscal year 2024 may have less than 30,000 HECM endorsements.

.

What is surprising to most industry observers is that our best fiscal year for HECM endorsements (fiscal year 2022) since fiscal year 2011 (expecting 2003?) was recently declared by HUD to be by far the worst fiscal year as to the Net Present Value of its Future Cash Flows as of 9/30/2023 for any fiscal year accounted for in the MMIF (Mutual Mortgage Insurance Fund). Primarily due to adverse selection, the estimate is a negative $807 million.

.

Despite what many falsely believe, a substantial increase in the HECM endorsement volume does not normally result in more cash to the MMIF. It usually results in negative cash flow.

.

There have been six fiscal years with higher HECM endorsement volume (2006, 2007, 2008, 2009, 2010 and 2011) than that for fiscal year 2022. The first four years of those six were years of increasing HECM endorsement volume when compared to the prior fiscal year. The last two years had falling HECM endorsement volume when compared to the prior fiscal year. H4P has never reached 2,700 HECM endorsements in any fiscal year since its creation in HERA of 2008. HECM Refinances (aka HECM to HECM Refinances) had never reached 9,000 HECM endorsements for a single fiscal year until fiscal year 2021 when that category had 20,584 HECM endorsements. The best fiscal year for HECM Refinances was fiscal year 2022 with 28,749 HECM endorsements. Last fiscal year that total was just 4,001.