“Should I live under a bridge?’ I get $5,600 a month in Social Security retirement income, but my property taxes will soon be $20,000. I have lived in Edmonds Washington for 49 years. Who can help?” So wrote one reader to Market Watch’s Advicer column. This widower’s dilemma highlights the devastating effects of inflation. Just what kind of inflation?

Housing inflation. The rapid runup of home values was a boon for many homeowners who found themselves sitting on a mountain of equity. In addition, surging prices benefited many reverse mortgage borrowers who refinanced harvesting even more of their home’s value.

However, for others higher home prices are anything but a blessing. This 76-year-old retired teacher brings in about $5,600 each month between his pension and Social Security. His staggering property tax bill would require him to set aside $1,600/month to meet his tax obligation! That’s over 28 percent of his gross monthly income!

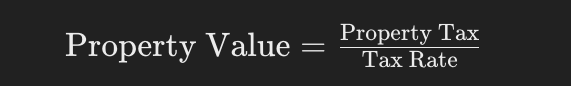

This reader is looking for a financial adviser despite not having much savings. A classic example of an older homeowner being very house-rich but cash-poor. With the average property tax assessment rate in Edmonds, Washington being 0.97% his home is likely assessed just north of $2 million.

What solutions can this highly taxed homeowner turn to? Kenneth Robinson, a CFP at Practical Financial Planning said, “You might be a good candidate for a modern reverse mortgage. I used to dislike reverse mortgages. Now, for many homeowners, they can be the most efficient way to stay in their homes.”

Another option is to sell the home and relocate to a lower-cost area of the state or another state.

Asset inflation is a double-edged sword. While it boosts one’s net worth it may saddle them with higher property taxes that could push long-time residents such as this widower out of the community he’s lived in for nearly 50 years. Such situations prompt some to ask ‘Do I really own my home or do I have to rent it from my local government?’

Regardless, marketing in areas with higher-valued homes may not always be about just housing wealth- sometimes it’s about survival.

No comment yet, add your voice below!