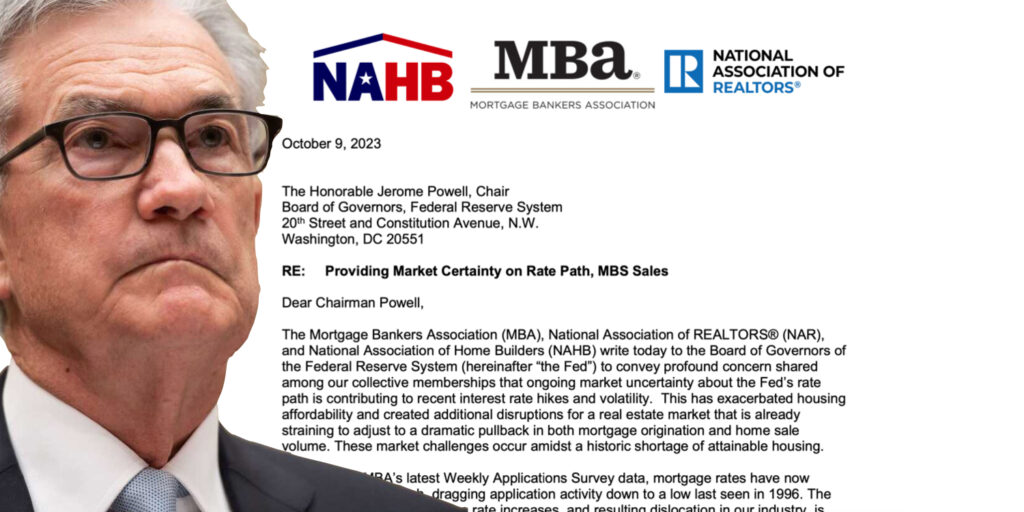

If there’s one thing you may want to share with your potential reverse mortgage borrowers it’s this. Last Monday, October 9th, The National Association of Realtors, the Mortgage Bankers Association, and the National Association of Home Builders wrote the Federal Reserve Chairman and the Board of Governors a letter petitioning the Fed to stop raising interest rates.

Why should older homeowners with substantial equity be concerned? Because the letter reveals what few real estate professionals or traditional lenders are willing to say out loud. That is the U.S. housing market is in a precarious position and so are home values and consequently senior home equity. Homeowners should be reminded of this one truism. That equity is a mere number, an illusion of sorts until it is separated from the home by either selling or tapping into the home’s value with a reverse mortgage or home equity loan.

The industry players expressed their -quote “profound concern shared among our collective memberships that ongoing market uncertainty about the Fed’s rate path is contributing to recent interest rate hikes and volatility”. The letter adds,

[read more]

“This has exacerbated housing affordability and created additional disruptions for a real estate market that is already straining to adjust to a dramatic pullback in both mortgage origination and home sale volume”.

It certainly has. But is there really any uncertainty about the Fed’s rate path? Following the most recent Fed meeting on August 25th Chairman Jerome Powell cautioned in his press conference, “We are prepared to raise rates further if appropriate, and intend to hold policy at a restrictive level until we are confident that inflation is moving sustainably down toward our objective. that further increases of the Fed funds rate may be necessary”. It seems the Fed has made their intentions clear. More rate hikes will be made if inflation is not on a path to their target rate.

Presently traditional mortgage rates have jumped to a 23-year high and now are edging near eight percent for the average borrower with good credit. Today’s high rates not only have pushed many potential homebuyers to the sidelines and decimated home sales, but they have added downward pressure to existing home values should the economy and the housing market encounter a hard landing. “We urge the Fed to take these simple steps to ensure that this sector does not precipitate the hard landing the Fed has tried so hard to avoid”, the trade groups said in their letter to the Chairman.

These trade groups are concerned that a hard landing in the real estate market would impact home values, new construction, and the overall economy. The letter notes that “Housing activity accounts for nearly 16% of GDP according to NAHB estimates”.

If there’s one point I cannot drive home enough it is this. What happens in the housing market and traditional lending has a profound impact on older homeowners and the potential outcome of getting a reverse mortgage. In many markets across the country, home values are still up 25-35% above their pre-pandemic levels. However, this letter to the Fed tells us that could change in the coming year.

Resources:

Letter to the Federal Reserve Chairman and Board of Governors

Housing Groups Tell Fed to Stop Raising Interest Rates

HECMWorld: Why the Fed is Breaking the U.S. Housing Market

[/read]

4 Comments

Rates rise – HECM falls.

But wait, I thought Powell told us inflation was “transitory,” and Yellen told us it would be “back to normal by end of 2021.” They need to wake up and stop watching lagging indicators.

Well said, Dan. So right about lagging indicators.

THE GOVERNMENT HAS BEEN LAGGING WITH FACTUAL DATE FOR ALMOST THREE YEARS WHATS NEW

Bill Krone