Here’s why the U.S. housing market hasn’t crashed

A looming recession, repeated interest rate hikes, and mortgage rates that have more than doubled. One would think such economic forces would lead to a housing crash. I certainly did. While home sale prices in several metros across the country have seen double-digit reductions, overall the national median home price has barely budged, in fact, according to Zillow US home values are up two percent year-over-year. What gives?!

First, housing crashes don’t happen overnight. They happen in stages. Case and point, the 2008 housing crash. Home sales began to plummet in late 2005 and 2006 followed by what some call a ‘dead cat bounce’- that is a short-term recovery followed by a protracted decline.

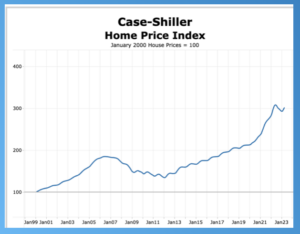

To illustrate this point let’s look at the Case-Schiller Home Price Index or HPI. This index measures housing price inflation by looking at repeated sales of similar single-family houses. using data from 16 of the nation’s 20 largest metropolitan areas or metros. The values use a three-month moving average. This chart uses January 2000 as the baseline of 100. In the wake of the 911 attacks, the Federal Reserve cut the fed funds rate to nearly zero where it remained for several years fueling one of the largest run-ups in home prices. By August 2006 the Case-Schiller Home Price Index peaked at 184 showing that home prices had appreciated by an average of 84% by May 2006. Then the subprime mortgage crisis began to gain steam steadily pushing down home price appreciation rates through February 2009 when the index had fallen to 149, or 20% below its 2006 peak. This was followed by a handful of false recoveries or dead cat bounces in August 2009 and June 2010. In total, it took nearly six years for the index to reach its trough.

[read more]

During the decade of February 2012 to February 2020, home prices rose steadily, that is until the Federal Reserve poured gasoline on the fire of housing demand again slashing the fed funds rate to nearly zero in the early days of the Covid-19 pandemic in the spring of 2020.

All of which brings us to the question- why haven’t home prices collapsed nationally?

Knowing that housing crashes often take years to play out what other factors are slowing a nationwide fall in home values? One factor is that housing inventory remains constrained which restricts supply. Another is our economy remains surprisingly resilient and has not yet fallen into a full-fledged economic recession with the resulting layoffs and unemployment that follow. If those two important pieces fall into place then the pace of home price depreciation would be accelerated significantly.

And surprisingly today’s high home mortgage rates are also propping up home values. Few homeowners that have a low fixed-rate mortgage want to sell their home, even at a significant profit and have to buy a new home with today’s high mortgage interest rates- rates that have more than doubled since the spring of 2022. This again constrains housing inventory.

But home sellers also play a role in inventory. Many who listed their homes this year at near-peak prices that were common in 2022 found few interested or qualified borrowers willing to pay the asking price at today’s interest rates. Consequently, many home sellers pulled their listings and have decided to sit and wait out the market. If housing inventory continues to grow and homebuyer demand is generally satisfied, then home prices would likely fall significantly. The rub is homebuyer demand is at a historic low due to high mortgage rates and inflated home values.

So expect that home prices will remain sticky until a significant economic downturn or black swan event pushes the first domino. Today, experts are widely divided on whether the market will crash, but the majority do agree that prices have cooled. Welcome to the holding pattern that is the U.S. housing market.

[/read]

No comment yet, add your voice below!