Soon 2022 will be history

That’s the refrain that should echo in the minds of reverse mortgage professionals as we finish the final days of 2022.

The year began strong with January HECM endorsements reaching their highest total for the month since 2018. However, when accounting that many of the endorsements that January came from the rush of HECM applications to beat HUD’s October 2017 HECM changes, January 2022 endorsements were the highest seen since 2012.

The CMT Soars

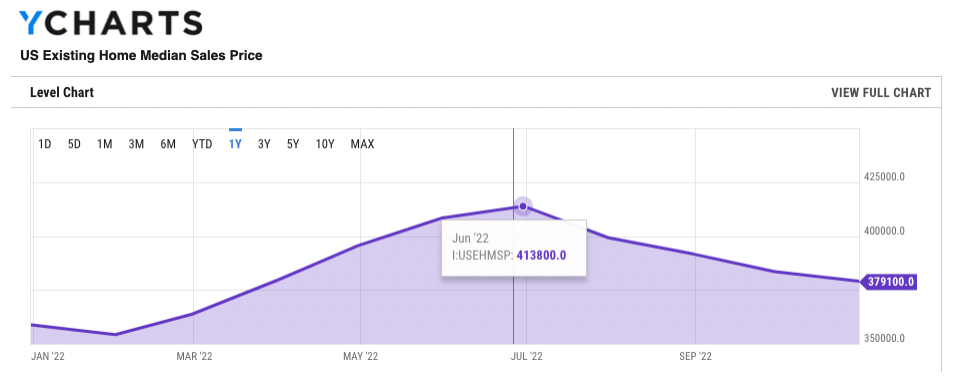

Throughout January and February, the 10-year Constant Maturity Treasury rate ranged from a low of 1.63% to a high of 1.83% by the end of February. The median sales price of homes sold continued a steady upward trajectory until the early effects of the Federal Reserve’s repeated rate hikes and climbing mortgage interest rates began to take their toll. Today the 10-year CMT index is hovering just below 3.5%.

HECM Refi Boom & Bust

HECM-to-HECM refinances ruled the day with nearly 50% of all HECM endorsements representing the refinance of an existing HECM in the months of January through April 2022. However, FHA case number application activity fell steadily from a high of 8,307 case numbers in April to 4,168 units in October, a decline that can likely be attributed to rising interest rates and dwindling refinance applications.

Inflation continued to climb throughout 2022 even after the Fed began to take aggressive action with a series of interest rate hikes whose pace exceeded any other series of rate hikes enacted by the central bank. Borrowers and lenders alike began to feel the sting of the Fed’s attempts to curb inflation as the fed funds rate was increased from .25% to 4.5% in nine short months.

What to watch for in 2023

Today HECM professionals are awaiting what 2023 will bring. How will lender consolidation change the landscape of reverse mortgage lending and public perception? Will the Federal Reserve eventually slow its pace of interest rate hikes? Will home prices stabilize or continue to decline in several markets? This week we outlined three trends reverse mortgage professionals will want to watch in 2023.

Until then we are currently curating HECMWorld’s top reverse mortgage stories for 2022. Look for the email in your inbox on Monday, December 26th, or of course, visit here at HECMWorld.com to see the year in review!

No comment yet, add your voice below!