[vimeo id=”23738513″ width=”601″ height=”338″]

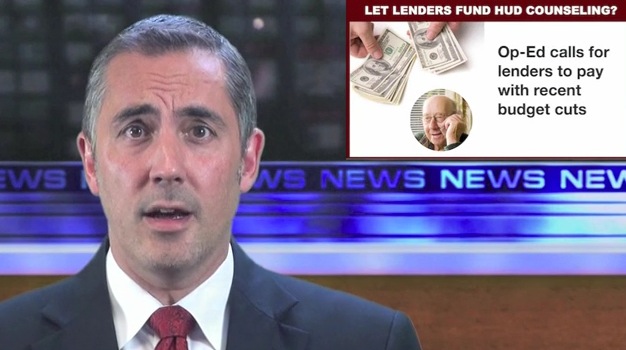

Op-ed calls for lenders to pay for HUD counseling with recent budget cuts.

[vimeo id=”23738513″ width=”601″ height=”338″]

Op-ed calls for lenders to pay for HUD counseling with recent budget cuts.

Share:

Editor in Chief: HECMWorld.com

As a prominent commentator and Editor in Chief at HECMWorld.com, Shannon Hicks has played a pivotal role in reshaping the conversation around reverse mortgages. His unique perspectives and deep understanding of the industry have not only educated countless readers but has also contributed to introducing practical strategies utilizing housing wealth with a reverse mortgage.

Shannon’s journey into the world of reverse mortgages began in 2002 as an originator and his prior work in the financial services industry. Shannon has been covering reverse mortgage news stories since 2008 when he launched the podcast HECMWorld Weekly. Later, in 2010 he began producing the weekly video series The Industry Leader Update and Friday’s Food for Thought.

Readers wishing to submit stories or interview requests can reach our team at: info@hecmworld.com.

Get the latest reverse mortgage news delivered straight to your inbox.

8 Comments

Having lenders contribute to counseling agencies no matter how it is done would still have the appearance of loss of independence. However, if HUD charged a counseling fee per endorsement request, then HUD would be the payee with no impact to the appearance of independence.

For cash flow purposes, the sooner the counseling tax begins, the better.

I agree…let the tax begin. The burden needs to be shifted away from seniors. If given to HUD for distribution there would be no suspicion of connection between counciling agency and lender.

Tom Kelly’s suggestion to have the lenders pay for the counseling fails to consider the fact that few, if any, companies has the will to do so, and in many cases they do not have the strength to do so. Put into place the burden would be put on the originating loan officer. Because the conversion rate is so poor and the compensation has been cut so drastically because of the Dodd-Frank bill, I would seriously doubt that many LO’s would make that choice. Add to that the fact that so many loans fail because of the lowered real estate values.

Our largest reverse mortgage originator offers customers a benefit called “Sharing advantage.” This is a charitagle contribution made on a customers befalf after the closing of their mortgage loan. The charity recieving the contribution must be a 501c to qualify. Perhaps we could establish the hud unit connected with counseling payment as this type of of charitable designation. Mortgage customers could choose to help others take advantage of counseling by designating this charitable unit as the contribution recipient. With over 17,000 closings a year, this could go a long way to help the same number next year. It could also be achieved as part of the application process amd je;[ am evem greater mi,ber pf fitire. No conflict of interest would occur since hed would still be administrating payment to the counseling service and no changes would be required for the current method of making that counseling service selection.

Perhaps you could elaborate. For example, the industry had over 78,000 endorsements last fiscal year. What is 17,000 about?

Some great ideas! Keep them coming…

I feel that Lender Paid counseling should be allowed. Too many Seniors simply do not have the Funds for Counseling, Yet are in need this program.

HUD needs to change several items that make no sense such as allowing lenders to pay for counseling, and allowing for credits in a HECM for purchase.

HUD can establish an agency that can choose the counselor for the customer (The gov loves to take charge of what ever they can). That way the lender can pay for the counseling and since HUD chooses the counselor, there can be no bias from the lender.

As to HECM for purchase, isn’t it just plain silly to allow the RE agent and seller to adjust the price on the contract in lieu of credits.